This Best-In-Class Retailer Could Be A Dependable AI Bubble Hedge

TJ Maxx and its sister stores worldwide have turned bargain-hunting into a business model that thrives in good times and bad. It’s a simple, low-tech formula that’s made TJX a dependable compounder.

When it seems like every retailer out there is obsessed with AI and same-day delivery, TJX Companies is an outlier. The off-price chain has built a compounding growth machine around its in-store “treasure hunt” vibe, turning its competitors’ mistakes and excess inventory into margin-rich opportunities. TJX’s edge is refreshingly analog: savvy buying teams, skilled store managers, and shoppers who love the thrill of a bargain.

So let’s take a look at this best-in-class retailer – and why it might deserve a place in your portfolio.

Part 1: What’s this firm all about?

The company

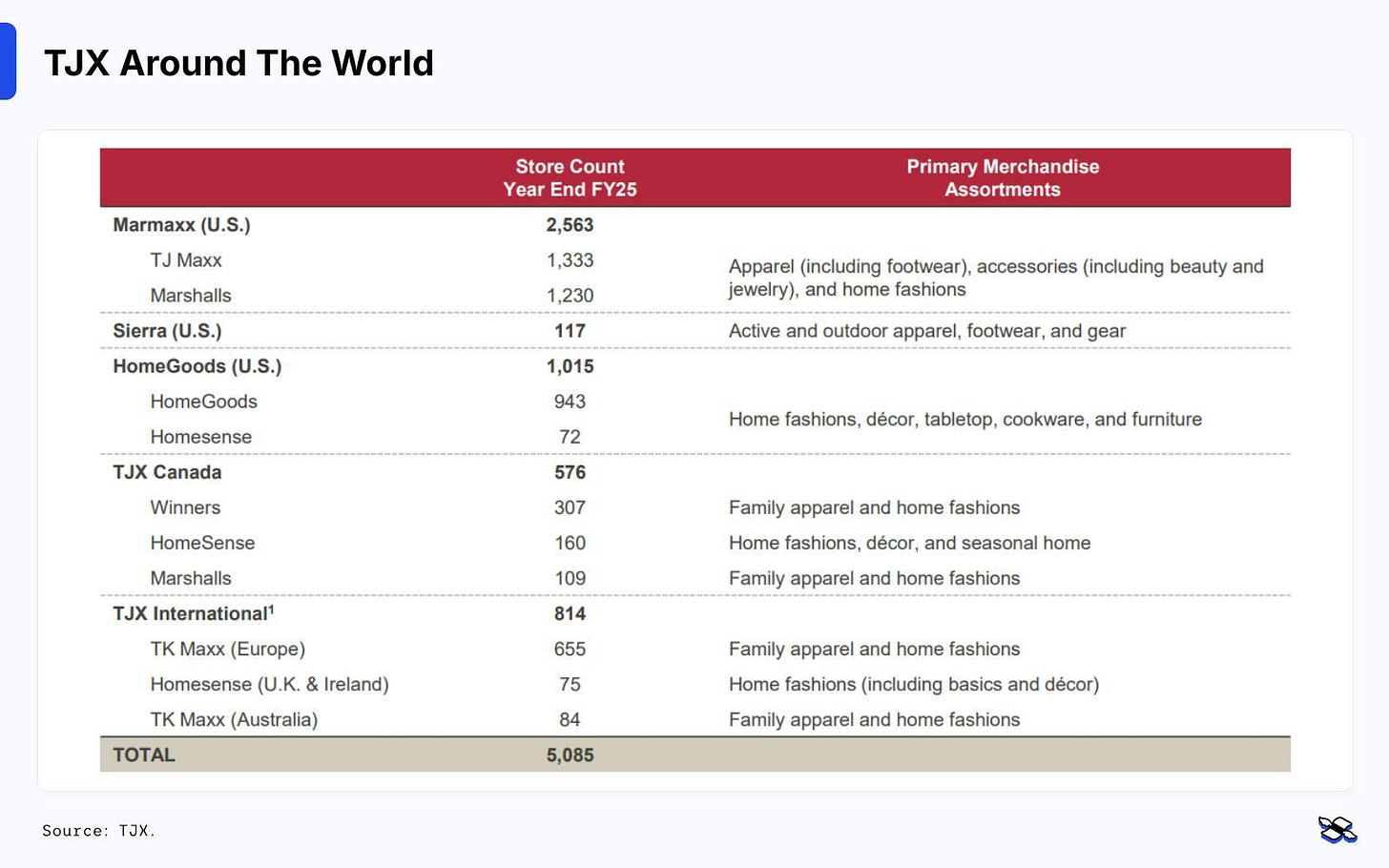

TJX is a global off-price retailer with over 5,000 stores across ten countries. It owns TJ Maxx (known in Europe as TK Maxx), along with Marshalls, Winners, HomeGoods, Homesense, and Sierra.

The whole TJX empire – from home furnishings to clothing, even outdoorsy gear. Source: TJX.

The business model is deceptively simple – and incredibly effective. TJX buys excess inventory from brands and manufacturers at deep discounts, then sells it to shoppers at prices that are 20% to 60% below traditional retailers, including department stores, specialty shops, and major online players. Customers span income brackets, but they’re united by one thing: they love a deal. They come for the “treasure hunt” experience – ever-changing racks of brand-name goods at bargain prices that reward frequent visits and impulse buys.

Unlike most retailers, TJX doesn’t rely on endless promotions, coupon codes, or gimmicks – just quality stuff at compelling prices, every day. And instead of buying inventory seasonally, TJX refreshes its stores several times a week. That constant churn gives shoppers a reason to keep coming back and a reason to buy now, before items disappear.

That same treasure-hunt vibe explains why TJX has happily defied conventional wisdom about the importance of ecommerce. Online sales made up less than 2% of the company’s sales last year. And that’s the point: the thrill of discovery works better in-store, and constantly shifting inventory doesn’t translate perfectly online because the firm can’t reliably restock its items or fit returns on its shelves.

TJX’s strategy is working particularly well at the moment, with a choppy retail environment creating phenomenal sourcing conditions. Volatile demand, supply-chain disruptions, and cautious shoppers have left a lot of brands sitting on excess inventory. Meanwhile, TJX’s $4.6 billion cash pile gives it plenty of power to pick up goods that its rivals are desperate to offload.

Storefronts

TJX’s business is spread across four main segments:

Marmaxx (US). TJ Maxx and Marshalls are the profit engine. These stores consistently deliver strong margins and bankroll growth elsewhere. Their recent comparable sales growth – a key retail metric that measures revenue changes at stores that have been open for over a year – has outpaced most of their US rivals.

HomeGoods (US). HomeGoods and Homesense are the growth engines. They got squeezed by high freight costs earlier in the decade, but then saw margins widen as shipping costs normalized. Plus, the collapse of Bed Bath & Beyond left a gap in the US that these stores are quickly filling.

TJX Canada. With fewer off-price rivals, TJX enjoys especially strong market share north of the border. Recent comparable sales growth here has been among the company’s strongest.

TJX International. Once a drag on margins, the international business is now delivering solid growth, with the off-price model gaining traction across Europe and Australia.

Industry

TJX operates in off-price retail – one of the sector’s biggest winners in recent years. As shoppers have grown more value-conscious, these chains have steadily taken share from traditional department stores. UBS estimates that the companies now generate 67% of combined sales in the broader department/off-price category, up 11 percentage points over the past five years. Even more telling: they capture roughly 81% of its total profits.

TJX’s closest competitors are the US-only Ross Stores and Burlington. Ross is well-run and profitable, but smaller. Burlington, meanwhile, has expanded quickly but has faced more volatility. TJX also competes indirectly with major department stores’ discount concepts (e.g. Nordstrom Rack and Saks Off Fifth) and with value retailers like Walmart and Target.

How TJX stacks up against its two main rivals on sales growth, margin, and return on invested capital. Source: Finimize.

Scale is TJX’s real superpower. It runs far more stores, operates globally, and employs 1,300 buying associates who source products from more than 21,000 vendors across 100-plus countries. That buying power lets TJX strike better deals, pounce on trends, and keep stores stocked with compelling merchandise even when others can’t. And with low operating costs and minimal ad spending, it’s built a moat that online-only rivals have struggled to cross.

Shares

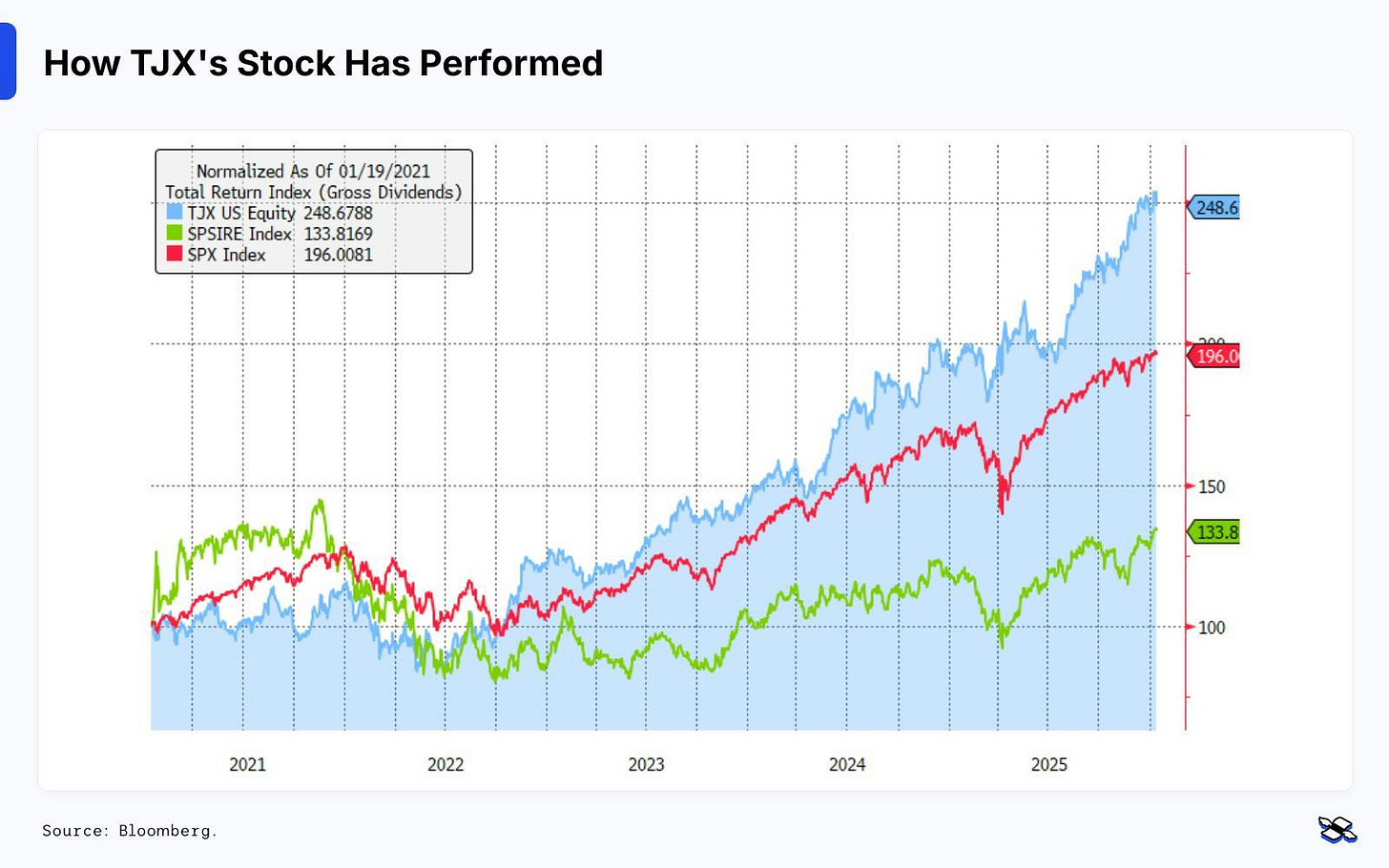

TJX had a flashy 2025. Its stock rose 27% – comfortably outshining the S&P 500, the overall retail sector, and its off-price pals. And that rally wasn’t just handed to it. The company delivered a better-than-expected run, with all divisions posting positive same-store revenue growth. In the most recent quarter, those comparable sales rose 5%, driven primarily by higher customer traffic – a sign that shoppers are actively choosing to spend at TJX.

Over the past five years, TJX’s stock (blue line) has outperformed the S&P 500 (red) and the wider retail industry (green). Source: Bloomberg.