Here’s What To Expect From S&P 500 Returns Over The Next Decade

Idea

The past decade made investing look easy – 13% returns per year from the S&P 500, no questions asked. But the next ten years are shaping up to be a whole different story, and if you’re betting on another blockbuster decade, you might be in for a nasty – and costly – surprise. See, even if you make some pretty optimistic assumptions, US stocks are likely to return a mere 5% per year. What’s worse, the risks are tilted to the downside. So this is a good time for a gut check. Let me break down how things have changed now and what it means for your portfolio.

Thesis

Three big forces drive long-term stock returns: dividends, earnings growth, and changes in valuations.

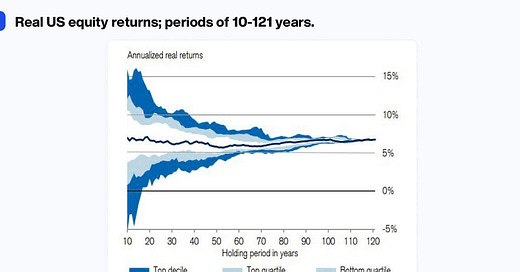

Ten-year returns have swung wildly throughout history – from a very satisfying 15% per year to outright losses, rarely landing anywhere near their long-term 10% average.

The best returns happen when expectations are low – like after a recession. Cheap valuations, pessimistic sentiment, and a low bar for earnings growth set the stage for a big upside surprise, as both profits and valuations expand.

The worst returns happen – you guessed it – when investors are too hopeful. When they ignore the risks and expect the gravy train to continue on forever, disappointment is almost inevitable.

So the starting point matters when investing – and today’s isn’t great. High valuations and record profit margins don’t just suggest below-average returns – they tilt the odds toward downside risk.

After making reasonable assumptions and stress-testing the numbers, I found three likely scenarios:

Scenario 1: The base case (50% probability, 4%-7% returns). Stocks would see steady sales growth, modest margin expansion, and a slight valuation dip – not a disaster, but still well below the past decade’s gains.

Scenario 2: The downside case (30% probability, near 0% returns). Margins would shrink and valuations would fall closer to historical norms, dragging returns to flat over the decade.

Scenario 3: The upside case (15% probability, roughly 10% returns). AI would drive major productivity gains and valuations would hit new highs – but it’d take near-perfect conditions to pull this off.

Keep reading with a 7-day free trial

Subscribe to Finimize Analyst Desk to keep reading this post and get 7 days of free access to the full post archives.