Close-Up On Ulta: Why Beauty Is In The Eye Of The Shareholder

It hasn’t looked so glossy since being dumped by Warren Buffett, but Ulta still has a glowing profile. So here's why this pretty stock might soon turn some heads.

When Warren Buffett buys into a stock, investors take notice. And when he sells it, you can bet they note that too. That’s exactly what happened this year with Ulta Beauty – a company that briefly caught (and then lost) the Oracle of Omaha’s fancy. But, here’s the thing: just because Buffett stepped away doesn’t mean this opportunity should be off the table for the rest of us. In fact, I think Ulta’s current valuation presents an interesting proposition that’s worth paying attention to.

Let me be clear: Ulta isn’t a quality compounding machine like Costco – a “buy and hold forever” type of stock. And it’s not a market-leading legacy brand that’s navigating past missteps like Nike either. Ulta’s runway for growth is narrowing, and it’s facing some real challenges. But when I see a high-return business trading at a 12-month forward price-to-earnings ratio of under 14x – a steep discount to its historical average – I sharpen my pencil. And when I factor in Ulta’s “omnichannel” strategy, loyal customer base, and potential to benefit from big-picture tailwinds like rate cuts and the recovery in China’s beauty market, the upside becomes pretty hard to ignore.

Buffett may have moved on, but for those of us looking for a mispriced gem in a resilient industry, Ulta could deliver. Let me show you why I think it deserves a look.

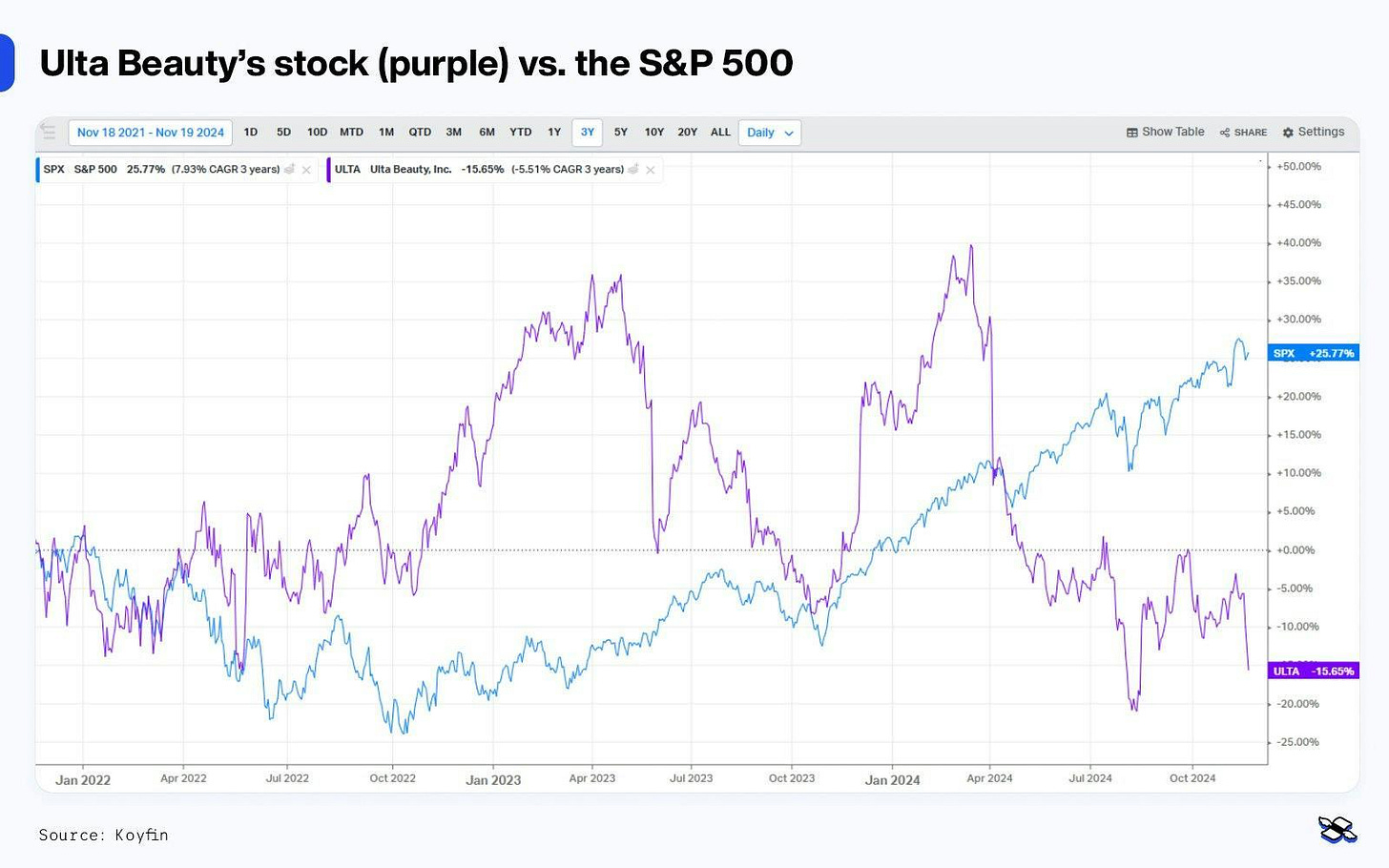

Ulta Beauty’s stock (purple line) hasn’t had an easy time of it in the past three years. Here’s how it has performed compared to the S&P 500 (blue). Source: Koyfin.

Thesis

Ulta’s got a smartly positioned omnichannel business model. The chain’s blend of physical stores, e-commerce, and loyalty-driven engagement gives it a unique place in the beauty market. After all, omnichannel shoppers spend nearly three times more than in-store-only customers – which lends itself to consistent revenue streams across channels. And with over 44 million loyalty members, the company continues to benefit from high customer retention and spending.

It’s set to benefit from consumer spending rebounds in China and the US. As a downstream player, Ulta is well-positioned to gain from the pickup in consumer spending that could happen if US interest rates continue to fall. Additionally, a recovery in China’s consumer market could indirectly boost Ulta by broadly boosting the beauty industry worldwide.

Ulta’s stock has an attractive valuation and asymmetric risk-reward potential. Ulta trades at a 12-month forward price-to-earnings ratio of 13.5x – that’s 40% below its five-year average and far less than the S&P 500. The firm’s valuation already prices in some big challenges, creating a potentially favorable imbalance in the risk-reward potential. With conservative growth projections of 5.8% annually through 2028, Ulta’s share price shows an upside potential of 30% to 68%, based on discounted cash flow and several valuation-multiples scenarios – and that’s with modest growth assumptions.

Ulta’s management recently authorized $3 billion in stock buybacks, representing 19% of its current market cap. Over the past ten years, that’s reduced the company’s share count by nearly a third, boosting EPS and enhancing shareholder returns. The stock’s low valuation right now only amplifies the value-creation potential of the buybacks, offering an additional margin of safety.

While expansion has moderated in recent years, the beauty industry is projected to outpace broader markets with a 6% compounded annual growth rate through 2028. Ulta’s revenue normalization reflects wider trends but still positions it as a leader in a growing sector.

Risks

Economic sensitivities. Ulta depends on consumers’ ability to spend on nice-to-have items, and that’s been under pressure lately because of high interest rates and inflation. And with middle- and lower-income shoppers focusing on essentials, that could further shrink demand for Ulta's products.

Competitive pressures. Yeah, we’re talking about Sephora here. With over 1,100 distribution points added, the big rival’s growing presence could further erode market share for Ulta and force it to drop prices, which would pressure its margins.

International expansion. Ulta's planned entry into Mexico will be its first foray into international markets. That diversification could unlock new growth, but it could also go badly. The firm could have trouble adapting to the consumer culture or clearing regulatory hurdles. Or it could turn out that its expected returns were far too high in this unfamiliar market.

Keep reading with a 7-day free trial

Subscribe to Finimize Analyst Desk to keep reading this post and get 7 days of free access to the full post archives.