Barry Callebaut: Why The Chocolate Maker Might Be An Investor’s Golden Ticket

After some bitter setbacks, the world’s biggest chocolate maker is ready for a sweet turn. Here are the scrumptious details – and a valuation model you can use.

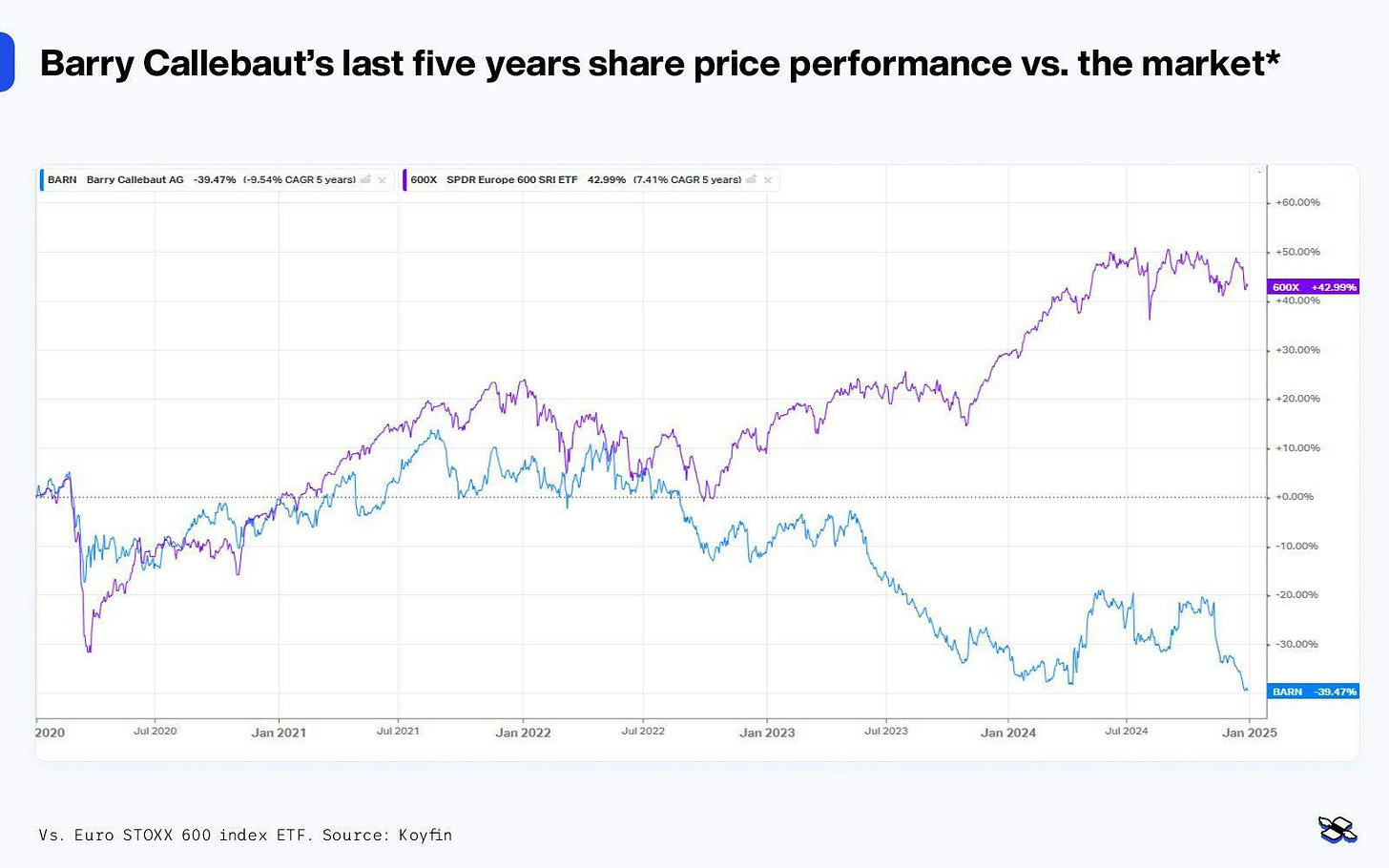

As a chocolate aficionado, I know a mouthwatering opportunity when I see it, and that’s why I’ve got my eyes on Barry Callebaut. The world’s biggest chocolate maker has seen its stock melt by 45% since 2022, after a series of unsavory setbacks. But beneath the wrapper here lies a tantalizing mix of factors: a resilient market, an expected cooling in cocoa prices, a plan to cut millions in costs, and a stock that’s already trading at a 60% discount to its historical average. Add in the rise in outsourcing trends from giants like Hershey and Mondelez, and you just might have a recipe for some sweet returns. Let’s have a look.

Barry Callebaut’s recent share price performance versus the Euro STOXX 600 ETF. Source: Koyfin.

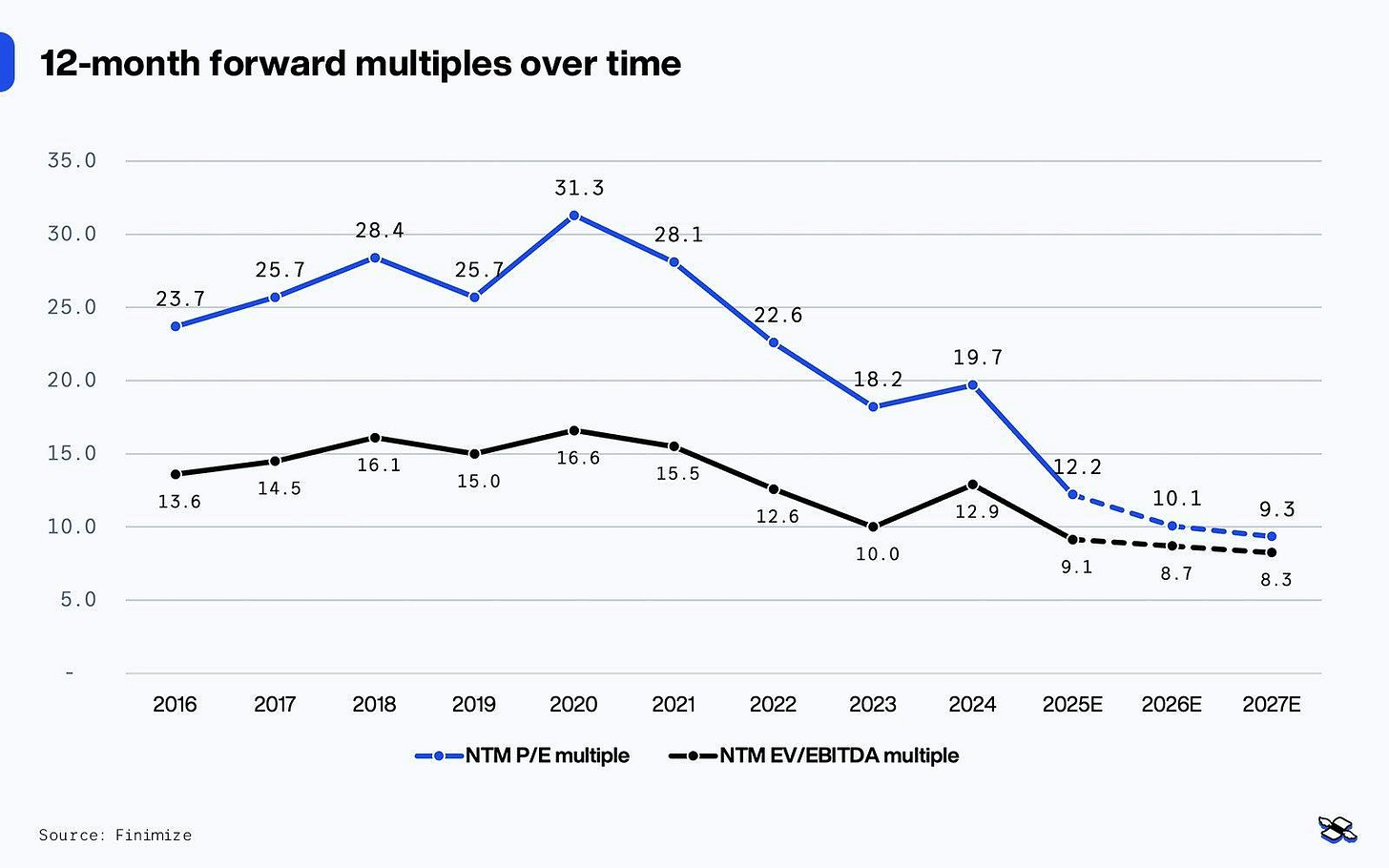

Barry Callebaut’s valuation over time. The blue line plots its price-to-earnings (P/E) ratio, and the orange plots its enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA). The firm has experienced a significant valuation reset since 2022, creating an appealing opportunity for investors in a stock with the potential to double. Source: Finimize.

Thesis

Barry Callebaut, the global leader in chocolate and cocoa production, presents a tempting investment opportunity, with its stock down 45% since 2022. And here’s the thing: that dip has happened because of a series of setbacks, but the structural resilience and long-term growth potential of the chocolate market remain intact, positioning Barry Callebaut for a notable recovery.

The company’s “BC Next Level” restructuring plan is set to deliver 250 million Swiss francs ($275 million) in annual cost savings, with the bulk of these efficiencies expected to materialize this year. These savings will provide a critical cushion against elevated cocoa prices, bolstering profitability and operational resilience.

Cocoa prices, which reached unprecedented highs in 2024, are expected to stabilize this year and next, offering relief to Barry Callebaut’s demand, cash flows, and balance sheet. And that makes this a potentially pivotal moment to invest in a high-quality company at what appears to be trough valuation levels.

Skyrocketing cocoa prices have forced smaller chocolate processors to shut operations or pursue acquisition deals. That disruption presents Barry Callebaut with potential opportunities to expand its market share by consolidating the industry and solidifying its leadership position.

The recent volatility in cocoa prices has highlighted the risks involved in in-house chocolate processing for major clients like Hershey and Mondelez, whose cash flows are seriously tied up in inventory during price spikes. And that may well accelerate the outsourcing of chocolate production to specialized players like Barry Callebaut, creating long-term growth potential.

Barry Callebaut trades at a forward price-to-earnings (P/E) ratio of 12.2x, representing a 60% discount to its three-year historical average (2019–2021). Based on a DCF and exit multiple valuation approach, the stock offers an attractive 80% upside, creating a rare opportunity to invest in a market leader at trough valuation levels.

Risks

Although cocoa prices are expected to stabilize in 2025 and 2026, prolonged price volatility or sustained record highs could continue to strain Barry Callebaut’s cash flows and balance sheet. The company’s cost-plus pricing model does offer some insulation, but persistently high prices might suppress chocolate demand, particularly in price-sensitive emerging markets.

Operational disruptions – such as factory shutdowns or supply chain issues – could present serious financial and reputational risks. A 2022 salmonella incident highlighted how certain bumps in the road can erode customer confidence and market share.

Barry Callebaut’s net debt increased quite a bit in 2024 because of higher financial needs related to those elevated cocoa prices. While much of that debt is tied to inventory and is expected to normalize, rising interest rates or liquidity constraints could limit financial flexibility and delay debt reduction efforts.

Shifting consumer preferences toward non-chocolate snacks or substitutes could reduce long-term demand for Barry Callebaut’s core products.

Global economic slowdowns, instability in key cocoa-producing countries, and currency fluctuations could disrupt supply chains and dampen chocolate demand.

Keep reading with a 7-day free trial

Subscribe to Finimize Analyst Desk to keep reading this post and get 7 days of free access to the full post archives.